Irs home depreciation calculator

For every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is in service for the entire year. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules.

Free Macrs Depreciation Calculator For Excel

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. You can calculate this percentage in one of two ways. Home Office Deduction at a Glance.

In our example Marks asset was ready for service in January and would depreciate by 4672 each. Area of home is 1200 square feet. The depreciation amount equates to 3636 of the adjusted basis depreciated each year.

Percentage of square feet. That means the total. Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses As for the residence itself.

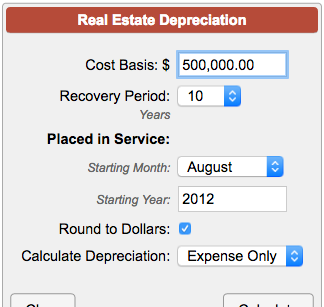

Also includes a specialized real estate property calculator. It is determined based on the depreciation system GDS or ADS used. The recovery period of property is the number of years over which you recover its cost or other basis.

Estimate your federal income tax withholding. If you use part of your home exclusively and regularly for conducting business you may be able to deduct expenses such as mortgage. First one can choose the.

Note that this figure is essentially equivalent to. Use this tool to. The MACRS Depreciation Calculator uses the following basic formula.

D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation. It provides a couple different methods of depreciation. In Form 8829 Part III provides the way to figure your.

See how your refund take-home pay or tax due are affected by withholding amount. Use our depreciation recapture tax calculator to determine the amount youll be taxed on the sale of your rental property and find out how to avoid depreciation recapture. This illustrates tables 2-2 a through 2-2 d of the percentages used to calculate the depreciation amounts on 5- 7- and 15-year property and residential rental property 275-year.

Depreciation on home office You can also get a portion of depreciation related to the house in proportion to the area. Additionally you can deduct all of the business part of your expenses for maintenance insurance and utilities because the total 800 is less than the 1000 deduction limit. Measure the size of your home office and measure the overall size of your home.

Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. Adjusted basis of house 270000 300000 30000 Depreciation Factor for the month of May 1605.

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Guide To The Macrs Depreciation Method Chamber Of Commerce

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Macrs Depreciation Calculator With Formula Nerd Counter

Residential Rental Property Depreciation Calculation Depreciation Guru

Straight Line Depreciation Calculator And Definition Retipster

Macrs Depreciation Calculator Irs Publication 946

Macrs Depreciation Calculator Straight Line Double Declining

Rental Property Depreciation Calculator Discount 59 Off Www Ingeniovirtual Com

Rental Property Depreciation Calculator On Sale 56 Off Www Ingeniovirtual Com

Macrs Depreciation Calculator Straight Line Double Declining

Residential Rental Property Depreciation Calculation Depreciation Guru

Automobile And Taxi Depreciation Calculation Depreciation Guru

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Rental Property Depreciation Calculator Flash Sales 53 Off Www Ingeniovirtual Com

Rental Property Depreciation Calculator On Sale Save 39 Countylinewild Com